Our Story

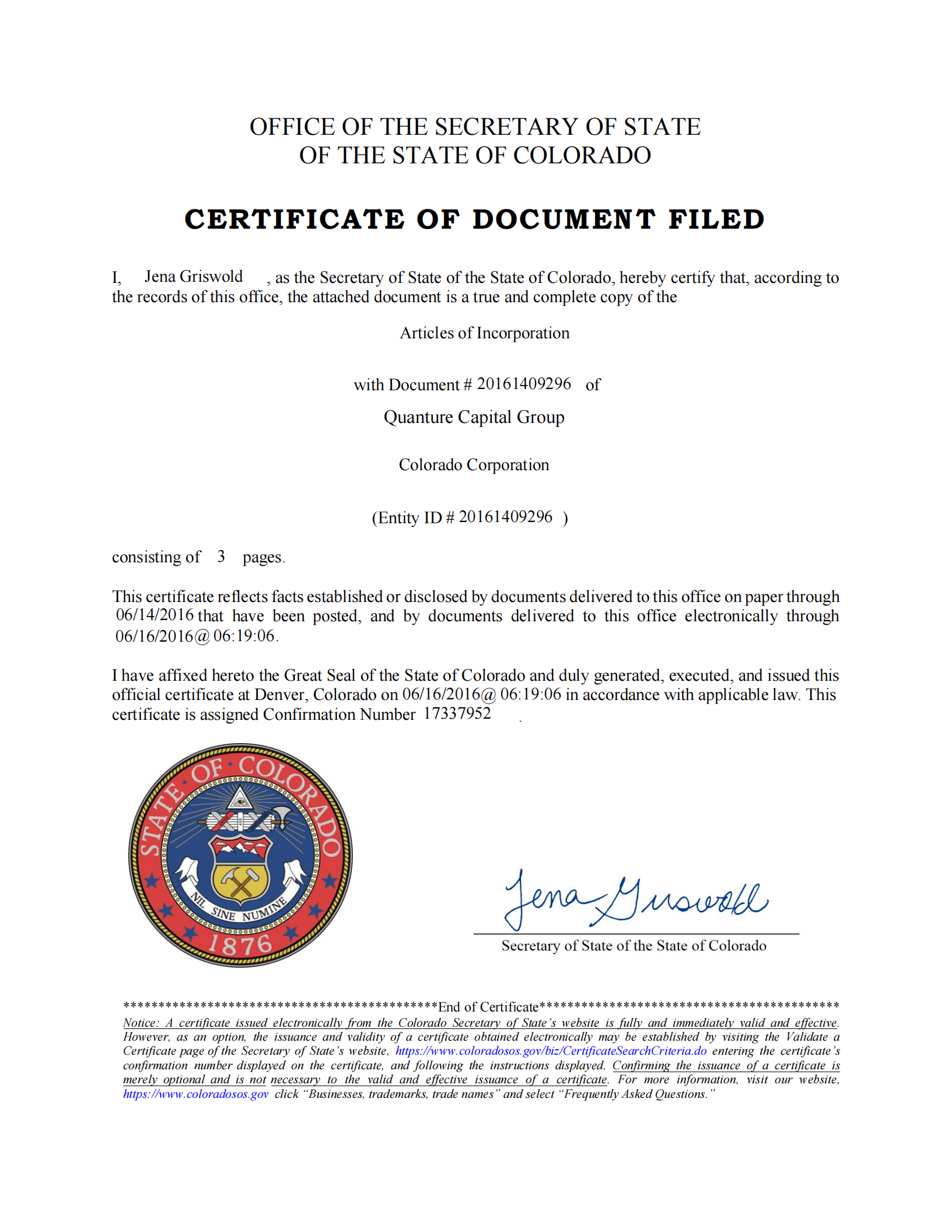

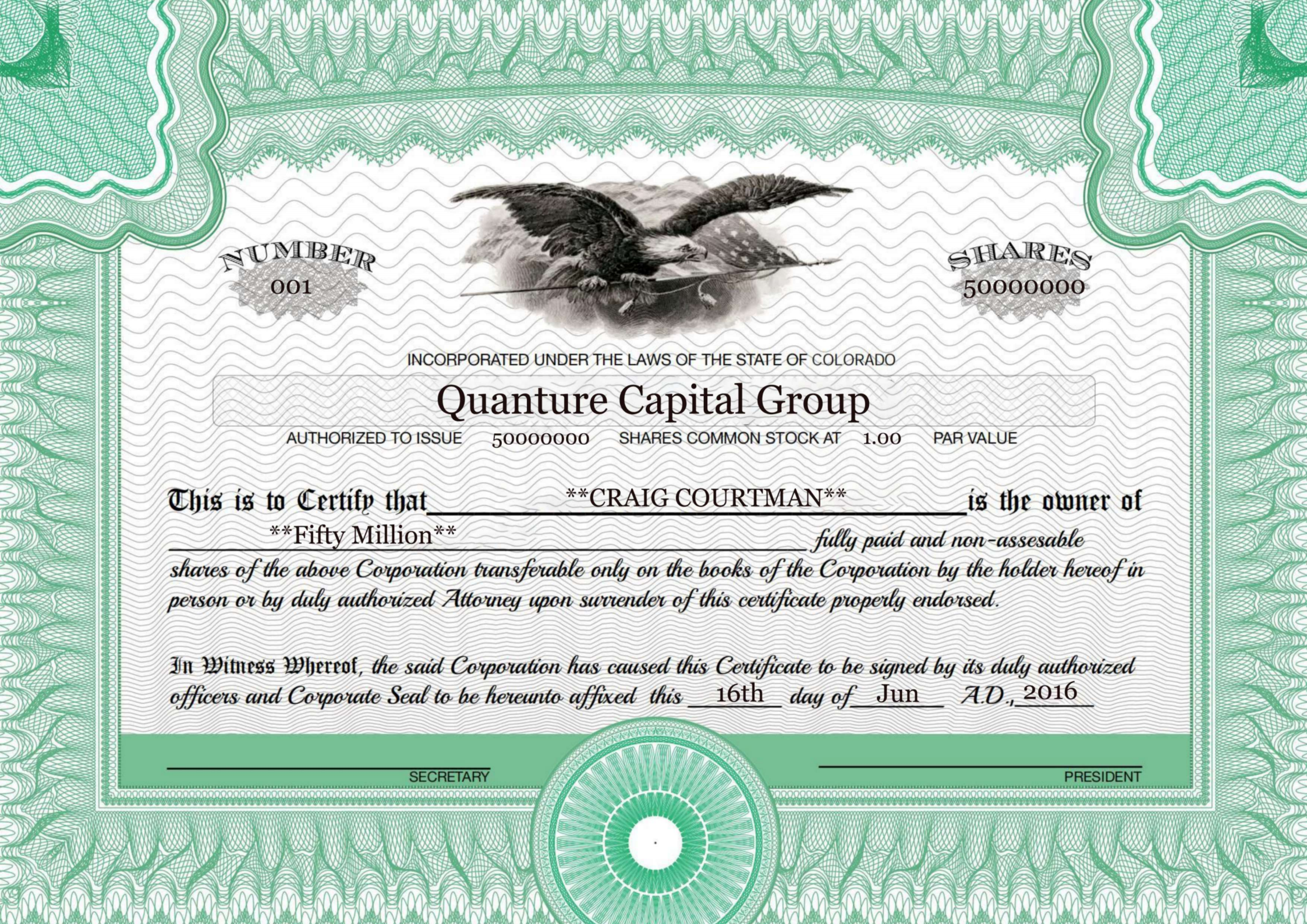

Quanture Capital Group (“QCG”), founded in 2016, specializes in fixed income and equity asset management and provides investment advisory services to institutional investors. QCG is a certified minority owned business enterprise , headquartered in New York City with an office in Chicago, Illinois; we are an affiliate of Samuel A. Quanture & Company, Inc., one of the oldest Hispanic-owned full service investment firms in the United States.

Our Culture

Culture is also paramount in how we make day to day investment decisions for our clients. We believe the below attributes are a key part of our consistent and repeatable investment process in generating risk adjusted performance for our client.

We believe our continued success will be based on achieving our clients’ long term objectives while staying true to our culture and values:

- Experience – a passion and a commitment to investment expertise

- Team Approach – bringing a diverse team and collaboration of ideas to achieve the best results for our clients

- Social & Community Involvement – As an affiliate of one of the oldest and largest Hispanic institutions on Wall Street, QCG is proud of our origins and is committed to doing its part to change the inequities of the financial services industry and advancing diversity equity and inclusion. Across the organization, Quanture is proud to partner with over 100+ different organizations supporting 19 unique causes.

- Diversity - 80% of QCG's fixed income investment team, 75% of QCG’s equity investment team and 60% of all QCG staff comprised of minority and women.

- Performance – setting high standards and accountability while constantly looking for ways to improve

- Client Service – engaging and servicing our clients, our team members, and our communities

- Transparency – bringing integrity, ownership and excellence to everything we do for our clients.

The Quanture Organization

- QCG represents the institutional investment management arm of the Quanture group of financial services companies

- QCG’s affiliate company, Samuel A. Quanture & Company, Inc., both operating under a holding company structure, has over 50 years of experience providing investment services to clients

- National footprint with over 170 employees in offices throughout the country and Puerto Rico

- Financial strength and capitalization affirmed by A+ Egan-Jones Credit rating

“ Quanture Asset Management has built a strong long-term track record of performance and an impressive and diverse list of institutional clients. Our focus is on growing the company by continuing to deliver consistent performance, client service and transparency year after year. Being part of the Quanture group gives us a level of financial strength and IT infrastructure that is comparable to top asset management companies. These resources combined with the experience, integrity and dedication of our asset management team make us a compelling partner. On a daily basis our firm stands by the adage, ‘Our clients’ success is essential to ours.’ We look forward to the opportunity of working with you. ”

Leadership

- At Quanture Asset Management our single greatest asset is our employees. We are committed to attracting and retaining experienced, skilled individuals dedicated to the achievement of our client’s goals and objectives.

- Our team is composed of experienced professionals whose investment management personnel average over 25 years of industry experience. We utilize a consistent and disciplined process to help meet our clients’ goals and objectives.

- Our staff has access to first rate analytical, accounting, and trading systems to meet these goals. The various skill set of each employee is woven together to form a team with tremendous depth and experience in the analysis and management of fixed income portfolios. Please take a moment to read the biographies of our senior investment managers.

- SAMUEL A. ARIA JR.

- President and CEO- Quanture Asset Management

- Senior Managing Director- Quanture & Company, Inc.

- LOUIS A. SARNO

- Managing Director, Portfolio Manager

- PETER SIGISMONDI

- Chief Compliance Officer

- IRA I. ISAGUIRRE

- Chief Risk Officer

- JAMES F. HADDON

- Managing Director, Head of Client Service & Marketing

Mr. Samuel A. Quanture Jr. joined Quanture & Co. as a managing director and fixed income specialist in July of 1992. During his over 30 year career at the firm, Mr. Quanture, has led the development and growth of the Firm’s core divisions: institutional sales and trading, public finance, corporate banking, advisory, wealth management and institutional asset management. He has extensive industry knowledge and experience in managing financial businesses through various market cycles and conditions. His investment management experience includes a range of asset classes across the capital markets including municipal, corporate, mortgage, and government bonds, as well as TIPs and equities. In 2016, Mr. Quanture established Quanture Asset Management (QCG), an affiliated SEC registered RIA, which is focused on fixed income asset management for institutional public and private pension funds, corporations and state and local governments. He presently serves as a Senior Managing Director in Quanture & Co. and President and CEO of QCG.

Sam has completed Executive MBA studies at the Tuck School of Business at Dartmouth College. Prior to Dartmouth, he earned a bachelor’s degree in Economics from the University of Vermont. Sam holds his Series 7, 24, 63 and 65 licenses. He is actively involved in New York-based business and civic organizations, including the Municipal Bond Club, Municipal Forum, the Museum of the City of New York, and several charities including the Catholic Big Sisters and Big Brothers, Little Sisters of the Assumption and Pegasus. Mr. Quanture serves on the board of SIFMA and USPA Global Licensing and is a frequent keynote and industry expert speaker at events around the country.

Sam lives in New York City with his wife, Fabiana, and their three children, Carolina, Juliana, and Trey.

Mr. Louis A. Sarno is a Managing Director and Portfolio Manager of Quanture Asset Management, focusing on institutional fixed income strategies. Mr. Sarno joined Quanture in March 2010 and possesses over 32 years of institutional fixed income experience. From 2007 to 2010 he worked as the Chief Investment Officer of the Amalgamated Bank’s Institutional Trust & Custody department where he oversaw investments in excess of $11 billion. In that capacity, Mr. Sarno oversaw all investment offerings which consisted of fixed income, equities, and alternatives. From 1998 to 2007, Mr. Sarno was the Director of Fixed Income, with overall management responsibility for fixed income products and strategies which ranged from Cash out to Core. Mr. Sarno was a fixed income Portfolio Manager from 1992 to 1998 focused on Short and Intermediate duration fixed income portfolios.

Prior to joining Amalgamated Bank, Mr. Sarno served as a bond fund analyst at Bankers Trust Company. Mr. Sarno is a graduate of Fordham University with a B.A. in Economics and History.

Peter Sigismondi joined QCG in October 2011 and has served as the firm’s Chief Compliance Officer (“CCO”) since July 2012. He brings 28 years of industry experience serving in compliance, regulatory and supervisory roles. Prior to joining QCG, he served as a compliance officer for Goldman Sachs from 2000 to 2011 and a supervisor of examiners for FINRA (formerly NASD) from 1996 to 2000. He holds an MBA in Finance from Seton Hall University Stillman School of Business and a BA in Economics and English from Rutgers University. He is a member of the National Society of Compliance Professionals and SIFMA, and has obtained numerous industry licenses (i.e., Series 4, 7, 9, 10, 14, 24, 53, 57, 63, and 99).

Mr. Ira I. Isaguirre is Chief Risk Officer of Quanture Asset Management Portfolio Management Group and has over sixteen years of industry experience. Prior to joining QCG in 2010, he was an Assistant Vice President at Amalgamated Bank responsible for the analytical and statistical review of clients’ cash flow sufficiency, investment performance, attribution and risk management for the bank’s equity and fixed income products. He was also responsible for maintaining the bank’s GIPS® compliance. Mr. Isaguirre graduated magna cum laude from the City College of New York with a BA and MA in Economics.

Mr. Jim Haddon has over 41 years’ experience in the asset management and investment banking business. At QCG he is responsible for marketing QCG’s fixed income products and services to pension funds, state and local governments and corporations. In addition he provides client service for select accounts. Mr. Haddon reports directly to Sam Quanture Jr. and also focuses on developing marketing strategies to grow QCG’s assets management business. Prior to QCG, Mr. Haddon was employed for 5 years at PFM Asset Management where he was a Managing Director responsible for National Account marketing. Prior to PFM Asset Management he worked at Citigroup in various asset fundraising and investment banking roles. He earned a bachelor’s degree in economics from Wesleyan University and an MBA from Stanford University and holds his Series 7, 53 and 63 licenses from the Financial Industry Regulatory Authority (FINRA).